The saying ‘tailor-made’ needs to be designed for personal loans. Personal loans have grown to be relatively simple to get in United kingdom. Increasingly more financial institutions came toward provide personal loans in United kingdom which too with innovative modifications to incorporate anybody in the circumference.

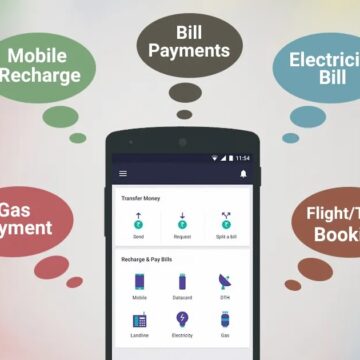

Let’s begin with the phrase personal loans. Personal loans are loans that exist by banking institutions for just about any personal financial reason. The banking institutions offering personal loans in United kingdom include banks, building societies, loan lenders etc.

Like all other loan, an unsecured loan must be compensated back. Time made the decision for that repayment from the loan is known as loan term. The quantity taken for an unsecured loan is decisive about a lot of things poor personal loans like repayment terms, rates of interest together with repayment term.

Guaranteed personal loans are individuals loans that are given against a burglar that is usually your house or any personal property much like your vehicle. The collateral placed may be the security by which the private loan is provided in United kingdom. This collateral functions because the security which guarantees for that repayment of loan. In situation of non repayment the private loan, the borrowed funds loan provider can seize your home.

Unlike guaranteed personal loans is unsecured personal loans. Unsecured personal loans in United kingdom are furnished with no collateral being placed. Therefore unsecured personal loans are a perfect option for tenants in United kingdom. Nonetheless, even homeowners can use for unsecured personal loans in United kingdom.

If unsecured personal loans are available to everybody then why would one obtain a guaranteed personal bank loan? Interestingly there’s a hitch? Unsecured personal loans include their particular drawback. The eye rate on unsecured personal loans is greater than guaranteed personal loans. You set no guarantee and therefore the interest rate is greater. Thus unsecured personal loans tend to be more costly that guaranteed personal loans. Visiting rate of interest you want to learn about APR. It’s a much publicized word but little comprehended. APR is this. It’s rate of interest billed in your loan. APR may be the rate of interest of the mortgage including additional fees like the interest, insurance, and certain settlement costs.

The eye rate on personal loans in United kingdom could be taken underneath the mind of variable rate of interest and set rate based on your convenience. Set rate on personal loans will stay the same regardless of the alterations within the rate of interest within the loan market. You will preserve on having to pay exactly the same rate of interest whether or not the rate of interest on view market drop.

While a flexible rate of interest continues fluctuating. Variable rate personal loans will also be known as adjustable rate personal loans. Adjustable rate personal loans are advantageous only when the interest rate drop. But when they interest rate increases your monthly obligations increases excess of the instalments you’d make. It’s a very unpredictable situation.

Personal loans are a perfect option when the cash is lent for under 10 years or any purchases or repayment of existing financial obligations. Personal loans are extremely determined by your individual situation and temperament. If you’re open regarding your conditions for your loan loan provider it is possible get an unsecured loan in United kingdom in compliance to your demands. Loan in basic form is loan borrowing. You are taking money and pay back it around the made the decision time. There’s no simpler method to describe on personal loans.